Recently, Indian GDP for June 2020 Quarter printed -23.9% growth. Interestingly, just a few weeks before this print, RBI MPC announced that it was holding rates steady because CPI inflation was at 6.93%, outside the target range of 2% to 6%.

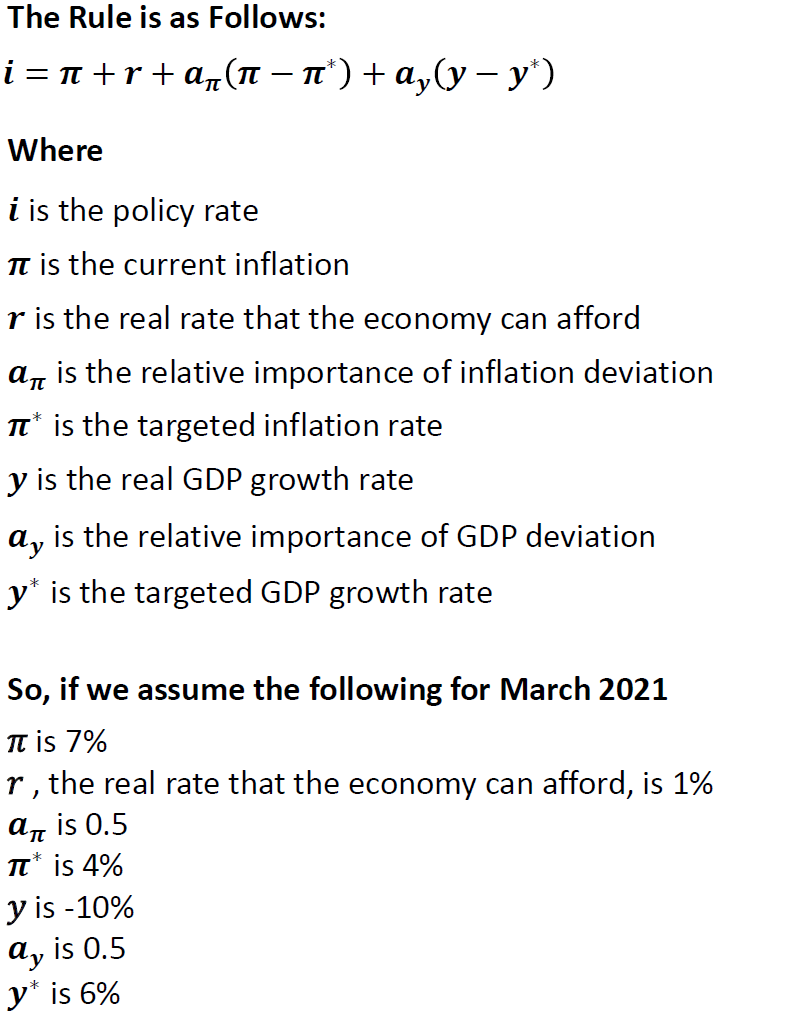

Is it appropriate to hold rates steady, when we have strong degrowth and supply disrupted (and not demand driven) inflation? There is a simple guide available. It is called Taylor rule of monetary policy.

So, we get policy rate in March 2021 should be at

i=7% + 1% + 0.5(7% – 4%) + 0.5( – 10% – 6%) = 1.5%

In other words, even if we assume that current supply chain disruptions continue causing high inflation, and at the same time oxymoronically assume that GDP growth rate for remainder of the year improves to -5.33% from latest reading of -24% (giving FY21 print at -10%); India will need policy rate of 1.5% rather than current 4.0%. Thus, we have room to cut rates by 250 basis points in next seven months.

Of course, I cannot imagine how inflation can stay at 7% when Keynesian multiplier is below 1.0 and when, in latest five months of pandemic, contrary to popular perceptions, RBI has not funded any central govt borrowings on net basis, and when commercial banks are refusing to lend to borrowers in spite of adequate deposit growth. However, we will go with strong inflation assumption and still find that India needs rate cuts of 250 basis points in next seven months.